Get a prenup! Get a will! You’ve been warned.

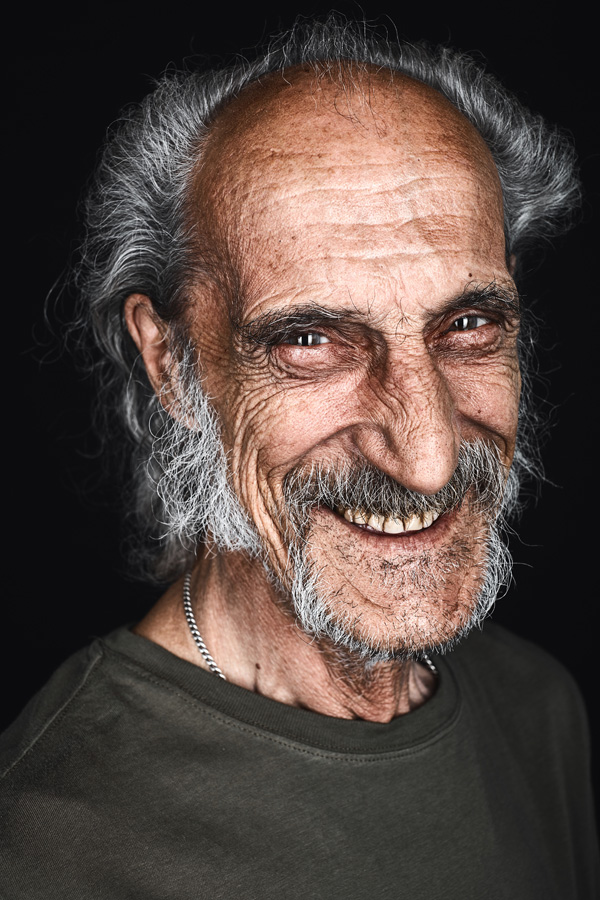

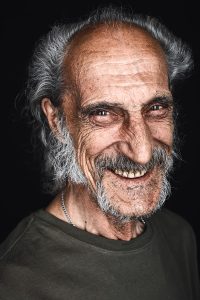

Sally, now 82, has been with Fred, now 83, for 10 years. They married last year against the advice of her children, her minister, the neighbors, and every human within a 5-mile radius. Fred, something of a seedy character who showers at least once a month, has his charms, especially when he has been drinking (thus, he is always charming unless passed out). His daughter is a money-grubber, but his son isn’t (mainly because he lives at NC Central – the prison in Raleigh, not the university in Durham).

Sally had a massive stroke a week ago, and son Tom tells me the docs are saying she won’t last long. He wants to know what will happen next.

I answered by throwing out questions. Any land? Yes, $200,000 with the home I was raised in on it, and all of it Sally’s. Any cash, investments, annuities, and the like? Yes, about $300,000, and all of it Sally’s. Does she have a will? Yes, it leaves everything to me. Did they get a prenup? No.

“So, what happens next, Bob?”

“Are you sitting down?”

The Year’s Allowance

First, I explained that old Fred would be entitled to a “year’s allowance” of $60,000 off the top. North Carolina law allows that amount to a spouse free of any creditor claims (and before any other estate plan scheme kicks in) to help the surviving spouse “keep it together” for a year.

Of course, that can be waived in a good prenuptial agreement (which Sally and Fred didn’t bother with).

The Intestate Share

Sally will not die “intestate” because she has a Will (that’s why we say she will die “testate”), Fred will not be entitled to a spouse’s intestate share.

Because I am trying to convince you how important a will is, let’s look at what would happen if Sally had no will. Fred would have been entitled to one-half of the real property (assuming Tom was Sally’s only child; if he had one or more siblings Fred would be cut down to one-third of the real property).

We’re not done. If Sally died intestate, Fred would be entitled to an additional $60,000 of the personal property and one-half of the balance (if Tom had any siblings, Fred’s share would drop to one-third). And that is AFTER he receives his $60,000 year’s allowance. So, based on $300,000 in personal property, Fred’s share would be $120,000 ($60,000 + $60,000) PLUS $90,000 (one-half of the remaining $180,000 after satisfying the two $60,000 hits). A grand total of $210,000. Son would get $90,000. Fred’s share would drop to one-third if Tom had any siblings.

Also, consider this: If Fred took this route (because Sally had no will), upon his death the grubby daughter and his NC Central son would take Fred’s share. I’m sure Tom will love sharing the homeplace with these characters.

By the way, all of that could be waived in a good prenuptial agreement.

So, cheer up, Tom! Your Mom had a will. But hang on. I’m not done.

Elective Share

If Fred is not happy with the will (and he won’t be when he realizes there is nothing in the will for him, and after his daughter gets through with him), he has a choice: File a petition to take an “elective share” of Sally’s estate, or claim a life estate against the real estate (he can’t do both; he must choose one or the other).

Because Fred and Sally have been married less than five years, Fred would be limited to 15% of Total Net Assets (I’ll get to that below). Between five and ten years of marital bliss, it jumps to 25%. Ten to fifteen, and it jumps to one-third. And once they’ve been married fifteen years or more, it climbs to 50%.

What are Total Net Assets? Basically, add everything up and subtract anything he may have received from Sally through other sources. When adding everything up add the total value of any real property, including any life estate in the property created after the marriage and to which he did not consent. Also, add in the value of any gifts made within a year of death.

In Fred’s case, he would have to settle for $75,000 (plus $60,000 year’s allowance, or a total of $135,000).

That’s better than the $210,000 intestate share, so it is good Sally had a will – and kept it in a safe place. There would have been problems had Sally’s will developed legs and gone MIA.

And, yes, all this could be waived in a prenuptial agreement.

Elect a Life Estate

As an alternative (sorry Fred, you can’t have both), Fred could elect a full life estate in the residence and a life estate of “one third the value” of the other real property. I have never seen that “one third the value” in my 24 years of practicing law in North Carolina. Nor could I find a colleague who had.

I believe that with respect to a large farming operation (for example) the surviving spouse would be entitled to one-third the annual proceeds of that operation.

He also gets everything IN the residence free and clear. I hope Tom had gotten his 1970s baseball card collection out of there.

The downside is that Fred would be responsible for property taxes (full on the residence), maintenance, and insurance. Tom could also sue him for it if he failed to do that.

If I were advising Fred, and unless he really needed a roof over his head, I’d advise him to “take the money and run.”

Finally

At the end of our meeting Tom (now quite shaken) asked me, “What if Fred had a bad accident

before Momma passes?”

I’m kidding! He did not ask that. But, not being the Lord, I have no way of knowing what might be in a man’s heart.

Final note: Look here at other late in life second marriage issues.

Bullzeye Fence, LLC

November 21, 2024 - 11:46 PMWow, what a whirlwind of late-life drama and estate law! It’s a fascinating (and slightly messy) case of love, legacy, and legal loopholes. Sally’s decision to marry Fred without a prenup certainly adds complexity, and it’s incredible how much North Carolina law factors into these situations. Tom seems to have a lot on his plate—between navigating Fred’s possible claims and preserving his mother’s wishes, it’s a relief she had a will in place. This really highlights how critical good planning is, especially in second marriages. Hoping for a smooth resolution for everyone involved!

Bob mason

August 5, 2024 - 12:37 PMSorry for the delay. Have been out of town. The health care agent under a health care power of attorney retains authority UNLESS, as part of the guardianship proceeding, the Clerk of Court suspends the health care power of attorney.

Monica

July 22, 2024 - 10:58 AMDoes anything change if Sally is deemed incompetent by the state and then Tom becomes her guardian?