New ways of counting assets. Penalties for transferring assets.

If you are even remotely interested in VA benefits such as Aid and Attendance or Housebound benefits under the VA Special Monthly Pension or Improved Pension you should read this article.

You’ve been warned.

Last week the Department of Veterans Affairs (VA) proposed sweeping new regulations that will change the way valuable benefits are calculated for qualifying veterans or their surviving spouses.

Last week the Department of Veterans Affairs (VA) proposed sweeping new regulations that will change the way valuable benefits are calculated for qualifying veterans or their surviving spouses.

If you are a veteran, the surviving spouse of a veteran or you know someone who is, and if you or “that someone” has even a remote chance of applying for benefits in the next few years, you must read thus. Things are about to change Big Time.

As I have been writing the past few years, Congress has threatened similar changes and has come close on a few occasions. Most of the bipartisan efforts were defeated because the VA benefit provisions were attached to bigger (doomed) bills that went down in flames.

This time is different because the VA is acting on its own with regulations. Barring something completely unforeseen some close variation of these regulations will become law sometime this year. We just don’t know when.

VA Benefits Background

Veterans who have served 90 days or more active duty during a war time period and have not been dishonorably discharged may be entitled to certain VA benefits if their health care expenses outstrip their income. If the veteran is “no longer with us” his or her surviving spouse may also qualify.

Read my explanation of how the benefit currently works, and then be sure to come back to this article. What you read for the current explanation is about to become HISTORY.

If you do not care to read about the current benefits, here is my 30 second synopsis:

If the veteran or the spouse has qualifying medical expenses, those will be deducted from income to calculate adjusted income. The difference between the VA benefit rate that applies to the individual and the adjusted income is the amount the individual will receive in VA benefits. The current VA 2015 benefits levels are posted on this website.

For example, if Archie qualifies for VA benefits due to his service during the Korean Conflict and he has income of $2,000 monthly but has $1,800 medical expenses, his adjusted income is $200. The maximum monthly benefit he could possibly be entitled to (because he is married to Edith) is $2,120. However, because he has $200 adjusted income, he will actually receive $1,920 ($2,120 ̶ $200).

We’re not done yet.

Next we have to look at Archie’s and Edith’s assets to determine what their net worth is and whether they are over the net worth limit. Not all assets count, but most do. I have explained all that elsewhere. In any event, they cannot have more than $80,000 worth of countable assets . . . but VA claims examiners regularly lower the $80,000 level on a case-by-case basis depending on their evaluation of the claimant’s income, age, health, marital status and the like.

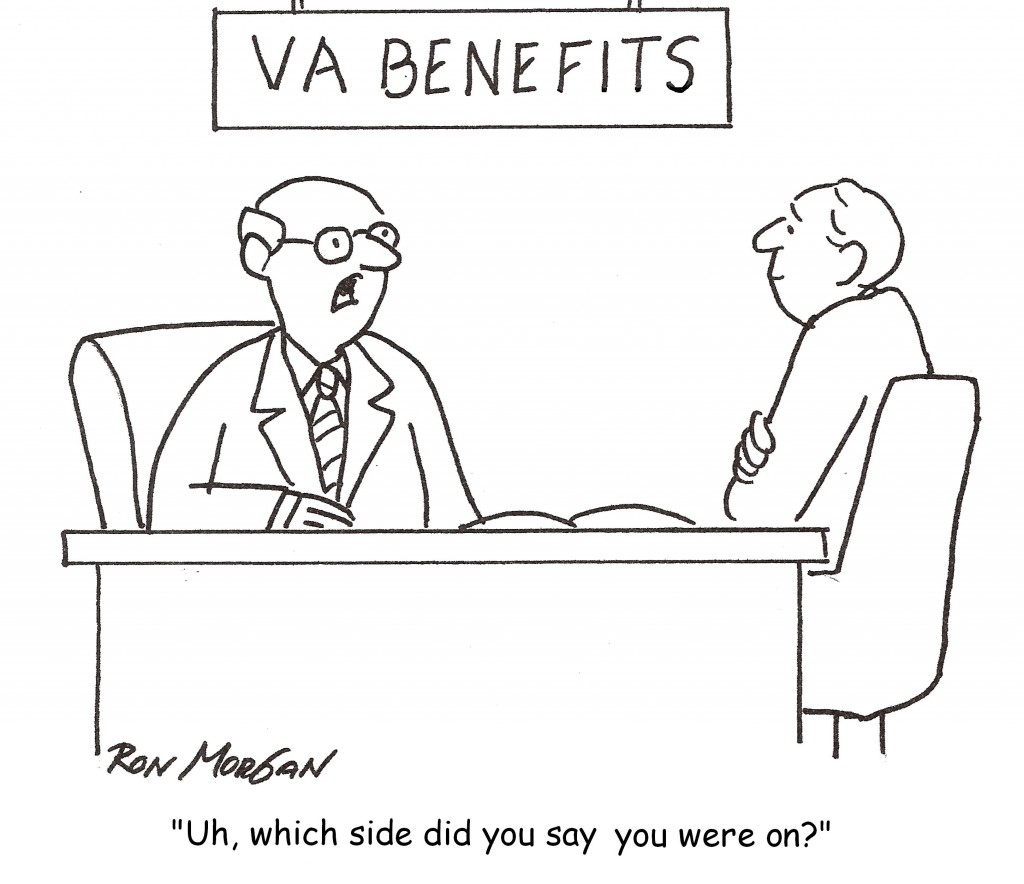

Crazy. Makes applying for VA benefits like Aid and Attendance very interesting.

Finally, there are currently NO transfer of assets penalties like Medicaid. Theoretically a millionaire could qualify under the asset test by giving everything away and applying the next day. But not for long!

Proposed VA Benefits Regulations: Turbulence Ahead.

New Asset Counting Rules

You MESSIN’ With My Benefits?

As mentioned above, VA has been applying a muddled asset test of “$80,000 or less” as a standard for qualification. As a practice, we at Mason Law, PC have submitted applications that take a “low ball” or conservative approach. Quite often we attempt to lower the claimant’s asset levels to around $30,000 “just to be safe.”

Perhaps on the positive side, the new regs will add a bright line test. Borrowing from Medicaid rules that allow a maximum community spouse resource allowance (CSRA) of $117,240 (2015 – this is adjusted every year), the proposed regs will allow countable assets plus income for the year (the proposed regs call this “net worth”) that total less than the CSRA in effect at the time of the application to be held without jeopardizing eligibility.

For example, if Archie and Edith had countable assets equal to $80,000 PLUS annual household adjusted income of $30,000 the combined $110,000 (called “net worth”) would be under $117,240 and Archie would pass the asset test. We’ll discuss what assets count, as well as how income is counted, below. Had Archie and Edith had assets of $100,000 Archie would not qualify because their net worth would be $130,000). End of story.

What Doesn’t Count

A principal residence and a “reasonable amount of land” around the house also do not count. Under the proposed rules, the VA will look to look to surrounding properties to determine a “reasonable” amount of land, but will cap it at TWO acres.

In other words, a house sitting on two acres when every other house in the neighborhood is on a quarter acre will result in 1.75 acres being counted. A residence sitting on a 100 acre spread out in farm country will result in one noncountable residence and 98 acres of countable real estate.

As under the current rules, automobiles and household effects (“consistent with a reasonable mode of life”) do not count. Also “basic living expenses such as food, clothing, shelter, or health care” will lower the asset level.

Asset Recap

To recap, add the value of all assets, subtract the value of the home (subject to the limit on land), subtract reasonable living expenses for food, shelter, and clothing, subtract the value of automobiles (no new Ferraris) and personal effects, and ADD income for the year (discussed below).

See what the total is. If it is less than the CSRA ($117,240 in 2015), you’re good to go. If over, then “Houston, we have a problem.”

New Income Rules

The VA imposes separate rules for income, because if adjusted income is over the VA maximum benefit available to a claimant, the claimant receives nothing. In any event, the benefit payable will only be the difference between the adjusted income and the maximum benefit available. Reminder: You may look up the maximum benefit available on this website. Don’t panic.

Income consists of “payments of any kind from any source.” Social Security? Income. Payments from a trust? Income. An inheritance? Income. A gift? Income.

But wait! Casualty losses (the insurance payment for the wrecked car)? Don’t count. Capital gains from the sale of an asset? Don’t count – BUT the proceeds may be added to assets next year.

And finally, medical expenses are deducted from income.

Bear in mind the regs do TWO things with income. They use one year’s income as an add-in to asset values to calculate “net worth” discussed above. They also use income to determine whether you have income less than or more than the maximum benefit available to determine how much you may actually receive.

For example, you can deduct food, shelter and clothing from the combined income and asset level (“net worth”) to see if you are under $117,240. But you can only deduct medical expenses from income to determine if the adjusted income is less than the maximum benefit available.

You have to pass BOTH TESTS.

Example. Archie and Edith have combined unadjusted income of $4,000. Archie is in the assisted living facility and they pay $3,000 for that (assume the assisted living facility expense is a qualified medical expense). The maximum monthly benefit available for a veteran with one dependent is $2,120. Assuming no other deductible expenses, the adjusted income is $1,000 ($4,000 – $3,000), and Archie will be entitled to a maximum VA benefit of $1,120 ($2,120 – $1,000). HOWEVER, they can still deduct food, shelter, and other expenses to see if they meet the “net worth” rules above and are under $117,240.

Clear as mud!

VA Transfer Penalties

This is where things get really interesting.

Currently the VA rules impose no transfer of assets penalty. They will soon.

When the VA receives an application they will ask for information concerning any transfers of assets that have been made within three years. Assets more than three years old they will not care about.

Once the VA determines a penalty, the penalty can be as long as ten (TEN!) years. Obviously, if an applicant is looking at a long penalty, it is better not to apply within three years after a transfer. Rack up a long penalty and apply, say, in 2 ½ years and you are toast; wait six more months and you are fine.

The penalty is calculated by dividing the value of the transfer by the Aid and Attendance maximum monthly benefit in effect at the time of the application and available to the applicant. For example, if Archie transfers a $212,000 asset (say the family farm) and, applies within three years, the VA will calculate a penalty period of 100 months based on the Aid and Attendance maximum rate available to married couple ($212,000 ÷ $2,120). The penalty runs from the time of the transfer. So, if Archie applies 10 months after the transfer, the penalty will be 90 months.

However, if Archie and Edith transfer property, and 10 months after Archie dies Edith applies for VA benefits the result will be different. Because the maximum VA Aid and Attendance benefit available to a widow is just $1,149, the penalty will be 184 months ($212,000 ÷$1,149). Because she applied 10 months after the transfer, the actual penalty applied will be 174 months.

However, if Archie and Edith transfer property, and 10 months after Archie dies Edith applies for VA benefits the result will be different. Because the maximum VA Aid and Attendance benefit available to a widow is just $1,149, the penalty will be 184 months ($212,000 ÷$1,149). Because she applied 10 months after the transfer, the actual penalty applied will be 174 months.

No fair? Yeah, well . . . .

The Take Away

The time to start planning is NOW. If you (or someone you know) think that VA benefits might be more than slight possibility within three years, now is the time to take action to protect assets.

As I often tell people, “No plan is a plan; no decision is a decision.”

We at Mason Law, PC have plenty of solutions.

Bob mason

January 24, 2018 - 6:06 PMYes, it could. Whether it affects you for more than a year depends upon how large and what you do with it. Get some good advice.

Bob mason

January 24, 2018 - 6:05 PMSorry, I missed this somehow. Whether the sale proceeds will affect his benefits depends upon his age and whatever else he might have. If he doesn't have much else, the addition of the $48,000 might not hurt him. On the other hand, if he is holding, say, $50,000 an additional $48,000 might cause him to lose benefits for a year.

Don

December 13, 2017 - 8:44 PMIf I am currently on aid and attendance,and my spouse receives an inheritance,will it affect me? I'm confused on this. Would it just affect it in the year she received it?

Diana Sorgatz

August 22, 2017 - 1:45 PMMy dad was awarded the Aid and Attendance benefit as of Aug 1, 2017 (his application was received March 24, 2017). He receives the full amount $1794 due to a non service related disability (aneurysm 20 years ago accompanied by strokes during the surgery). He receives SS of $1530, and an autoworkers pension of $1130 per month. He agreed to the rating of incompetence due to needing help with financial matters, and if approved, I, his daughter, will become his fiduciary. My question is this; after my moms sudden death last year, we acted quickly once he started showing signs he couldn't live on his own 4 hours away from us without injury. We found an assisted living facility near us, started the A and A application process with the help of an attorney who specializes in getting VA benefits, and put his house up for sale. Well he just got a buyer, and will receive after all realtor costs about $48,000. I know we must let the V.A. know of this income when he receives it, but will it disqualify him from his A and A benefits? I have read differing opinions online, but it seems like such a minor amount to effect his eligibility he has a 100% disability rating and sold his house below appraisal if that makes any difference. Sorry for the long post, just wanted to state all the facts. Thank you for your response.

Bob mason

July 31, 2017 - 9:27 AMThe proposed regs are still floating around out there. No one seems to know anything definitive. The change in administrations has thrown everything into a fog. That being said, every knowledgeable person I talk to thinks they're still coming . . . this summer, this fall, who knows . . . but they're coming. Whether the regs are prospective or retroactive, we do not know either. We certainly hope prospective only. We just do the best with what we have! Sorry.

Kathy

July 31, 2017 - 9:17 AMHave the new recommendations for the VA Aid & Assistance Benefits been enacted by the VA as of July, 2017? If not, can you give me an update on the probability of this happening soon? If a veteran applies now and during the process of review they are enacted, will the new rules apply or does the VA take into account when he applied?

Brenda L. Therry

June 21, 2017 - 3:23 PMThis is for the Aid and Attendance Program.....

Brenda L. Therry

June 21, 2017 - 3:22 PMHas the 3 year 'look back period' gone into effect. I have read that it's still pending. I cannot find any confirmation of the new rule. thank you

Tammie Crenek

April 11, 2017 - 4:40 PMMy mom received her first aid and attendance check this month. She is currently living in an assisted living facility after she suffered a stroke. We were hoping that she would recover enough to return to her home, but now after another stroke, we are sure that she will more than likely remain in assisted living. The money is going fast and we now need to sell her home to cover the expenses. Is there a way to sell the house without losing her benefits? If we sell it and then gift the money before the new regulations take effect, will she be disqualified next year when they reaccess her financial situation?

Bob mason

April 10, 2017 - 9:20 AMTammie, I cannot give legal advice via a website. Not only would it get me into hot water with the Bar, but it is not a wise thing to do since there could be so many other relevant facts. You need to see a qualified elder law attorney. That being said, selling the house now would very possibly disqualify her from further VA benefits for at least a year (and then only if other corrective action was taken). If she is in NC she may qualify for Special Assistance and Medicaid. The other thing to consider is what the likelihood is of her moving to a skilled nursing facility (in which long term care Medicaid benefits might be relevant). Sorry I can't be of more help in this setting.

Tammie Crenek

April 9, 2017 - 9:57 PMMy mom received her first aid and assist benefits check this month. She is currently living in an assisted living facility after she suffered a stroke. We were hoping that she would recover enought to return to her home, but now after another stroke, we are sure that she will more than likely remain in assisted living. The money is going fast and we now need to sell her home to cover the expenses. Is there a way to sell the house without losing her benefits? Should we gift it and just pay the capital gains taxes or can we sell it and then gift the money or is there another option?

Bob mason

March 27, 2017 - 9:21 AMYou haven't told me what sort of VA benefits one of them has, so I can't say for sure. If one of them has VA's Special Monthly Pension (Base, Housebound, or Aid and Attendance) then, yes, they will lose benefits for a year and until they get spent down to the appropriate levels. It is very rarely a good idea to sell a residence after applying for VA benefits because of this.

Jodi

March 25, 2017 - 11:35 AMMy in laws sold there home in june 2016 with a cash profit of 173000.00 they did not report the income until filing there taxes, now va is calculating. Will they loss there benefits because of the 80000.00 cap?

Bob Mason

August 7, 2015 - 9:38 AMSorry this took so long . . . I missed your post somehow. Transfer the excess money NOW (either directly to you or someone else or to a trust). I'd get her down to about $35,000 or $40,000 in her name to be safe. Then apply. CURRENTLY, VA has no transfer penalty. Do it NOW . . . get the ball rolling!

Bobbi

June 24, 2015 - 7:22 PMI have been told by several people that this 80,000 is a starting point but they really want lower, my mom is in assisted living and we are nearing the 80,000 mark , she is only 71 with Alzheimer's so I am not sure if I should apply when we hit the 80 or wait , if we get denied we will go thru money too fast , also she was married to my dad when he passed away and after was married for two days and had an annulment , does that disqualify her since an annulment =means it never took place

Bob Mason

May 24, 2015 - 2:10 PMBonita: Service connected disability is completely different from "special monthly compensation" (which is the program that is subject of the proposed regulations). The only way a survivor will receive anything when a veteran dies while receiving service connected disability is if the veteran died fromthant disability. The survivor's benefit is called Dependency and Indemnity Compensation. However, even if your mother is not eligible for DIC, she might be eligible for Special Monthly Compensation if her health care needs warrant it and she is under asset threshholds. And, no, the transfer regulations are still in limbo and Congress is getting ready to once again join the act. They're coming . . . it's just a metter of when.

Bonita Millik

May 21, 2015 - 6:27 PMMy Dad just passed away and had 100% service connected disability for 8 years from the Korean War. My parents have around $200,000 in various CDs. My Mom said according to the VA she will probably not get anything. She is 80 and only has that to live on for the rest of her life. Does that sound right? Is the transfer of asset penalty in effect yet?

Bob Mason

March 1, 2015 - 10:22 AMSee my previous response.

Bob Mason

March 1, 2015 - 10:22 AMIt won't at all. The changes proposed apply only to Special/Improved Monthly Pension, which has nothing to do with service connected disabilities.

Susie Cranford

February 25, 2015 - 11:35 PMHow will this effect 100 percent service connected total disabled veterans and spouse?

Susan Cranford

February 24, 2015 - 8:09 PMIn reference to the newspaper article, how does this effect 100 percent total and permanent disabled veterans and their spouse.

Bob Mason

February 15, 2015 - 8:49 AMI recommend Dave Silver at Graham, Nuckolls & Conner in Greenville, NC. 252-493-6114.

Bob Mason

February 11, 2015 - 12:13 PMPlease contact me off this public forum for a referral.

Jackie white

February 6, 2015 - 9:17 PMplease refer to very experienced Asheville atty.

Tim Fulcher

February 4, 2015 - 12:27 PMMy father (deceased in 2000) was a veteran of the Korean Conflict. To my knowledge, neither he nor my mother (retired public school teacher, now 84) has never applied for VA benefits - but I think she should. I live in VA, and visit her in Washington, NC about every 2 months. I would love to visit your office in Asheboro, but that would be very difficult for her. Would you please recommend a good elder law attorney in either Washington or Greenville, NC - especially one who can help with VA benefits. Any other advice you can include here would be greatly appreciated!

Bob Mason

February 2, 2015 - 9:57 PMProbably not.

Bob Mason

February 2, 2015 - 9:56 PMJackie: You have a lot going on here with a number of different issues. More than I can respond to in a com box. Perhaps you need to schedule an appointment with either me or someone geographically convenient to you. I'd be happy to refer you to someone.

Jackie white

February 2, 2015 - 1:26 PMAm 68 unmarried 70% disabled unemployable female Vet. Asset $125000 house 250000. Have disabled, son, not good with money. am not planning on leaving him my estate. Have one distant brother. Want to sell house, should I buy or rent and need to replace car. house is paid for.. Should money go back into house or less money in home. Income 4000 per mo. Am very worried about what to do. Most probably will end up in a VA facility later in life. These seem like some really big changes. Any suggestions. thanks . You helped me once before with information and I was so greatful.

Harold Welch

February 2, 2015 - 11:22 AMWill this affect someone who has a trust already set up and has been receiving benifits for a couple of years?